Market Volatility and Recovery: Q2 2025 Investment Highlights

Jul 9, 2025

The second quarter demonstrated both the sensitivity of financial markets to policy uncertainty, but also their resilience and ability to adjust rapidly to new information. From the White House’s tariff announcements in April to escalated tensions between Israel and Iran, in June, investors faced many challenges. Yet, the stock market went on to stage one of the fastest rebounds in history and finished the quarter at new all-time highs.

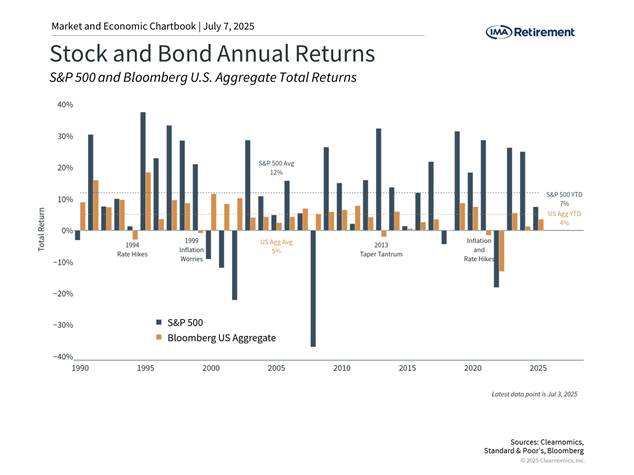

Stocks delivered impressive gains while bonds provided steady support for balanced portfolios. These developments serve as a valuable lesson for long-term investors: while news cycles can create temporary market disruptions, maintaining focus on underlying economic fundamentals remains essential for reaching financial objectives.

The market recovery proved widespread across sectors, investment styles, and geographic regions. The quarter started with considerable uncertainty following April’s comprehensive tariff announcements, which exceeded many investor expectations. As the administration pursued negotiations and secured preliminary agreements with trading partners, market confidence returned. Similarly, Middle East conflicts initially created volatility, but markets demonstrated resilience following the Israel-Iran ceasefire announcement.

International equities continued their 2025 leadership, particularly benefiting from dollar weakness. Small-cap stocks underperformed due to heightened tariff sensitivity and domestic exposure, with the Russell 2000 remaining down 2.5% year-to-date. Within the S&P 500, Technology stocks drove much of the recovery to new highs. Additional sector support came from Industrials (up 11.4% year-to-date), Communications (gaining 10.2%), and Financials (advancing 7.5%). Healthcare and Energy sectors faced headwinds during the period.

Federal Reserve policy remained steady, holding rates at 4.25% to 4.5% throughout the quarter. Fed Chair Jerome Powell emphasized the central bank’s commitment to price stability amid evolving economic conditions. Updated Fed projections reveal policymaker challenges, with inflation now expected to reach 3% in 2025 before moderating to 2.1% by 2027. Real GDP growth forecasts were reduced to 1.4% from the March projection of 1.7%, reflecting concerns about tariff impacts on both inflation and growth.

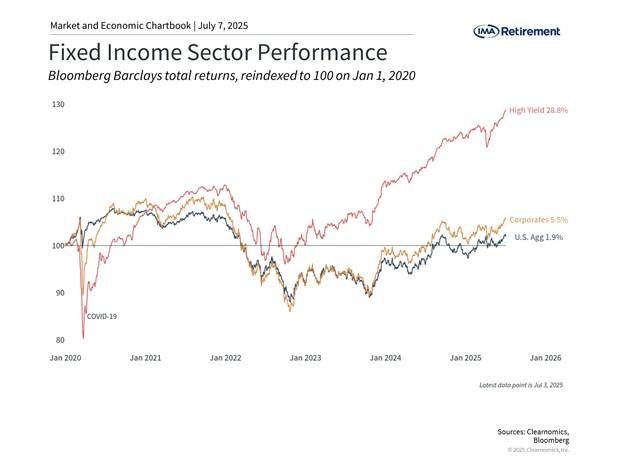

While equity markets reached new highs, the volatility experienced during the quarter challenged many investors. Bond holdings proved valuable for portfolio balance, with high-yield, corporate, and Treasury securities all contributing positive returns year-to-date.

The bottom line? The second quarter illustrated how markets can overcome short-term volatility through underlying economic strength. Maintaining diversified portfolios and long-term perspective remains the most effective approach for achieving investment success.

Investment advice provided by IMA Advisory Services, Inc. (IMAAS), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. IMAAS is also a registered insurance agency. The Message is for informational purposes only; it is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any securities transaction. California License: IMA Advisory Services, Inc., dba IMA Wealth & Insurance Services #OG17811

Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. Assumptions, opinions, and estimates are provided for illustrative purposes only and are subject to significant limitations. Estimates are subject to uncertainty and error and could be significantly higher or lower than forecasted. They should not be solely relied upon as recommendations to buy or sell securities.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable. Consult your investment, tax and legal advisors before making investments. IMAAS does not provide tax or legal advice.

The information in this document is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. Given the complex nature of risk-reward trade-offs involved in portfolio construction, we advise clients to consult with their financial professionals on specific investment-related decisions. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. In addition, past performance is not a guarantee of future results.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.