Why Investors Are Reminded to ‘Stay the Course’ During Market Volatility

Mar 31, 2025

Market volatility can be unsettling. When headlines scream about market drops and economic uncertainty, it’s natural to feel anxious about your investments. The instinct to “do something” can be strong, but making impulsive decisions during short-term market swings often does more harm than good.

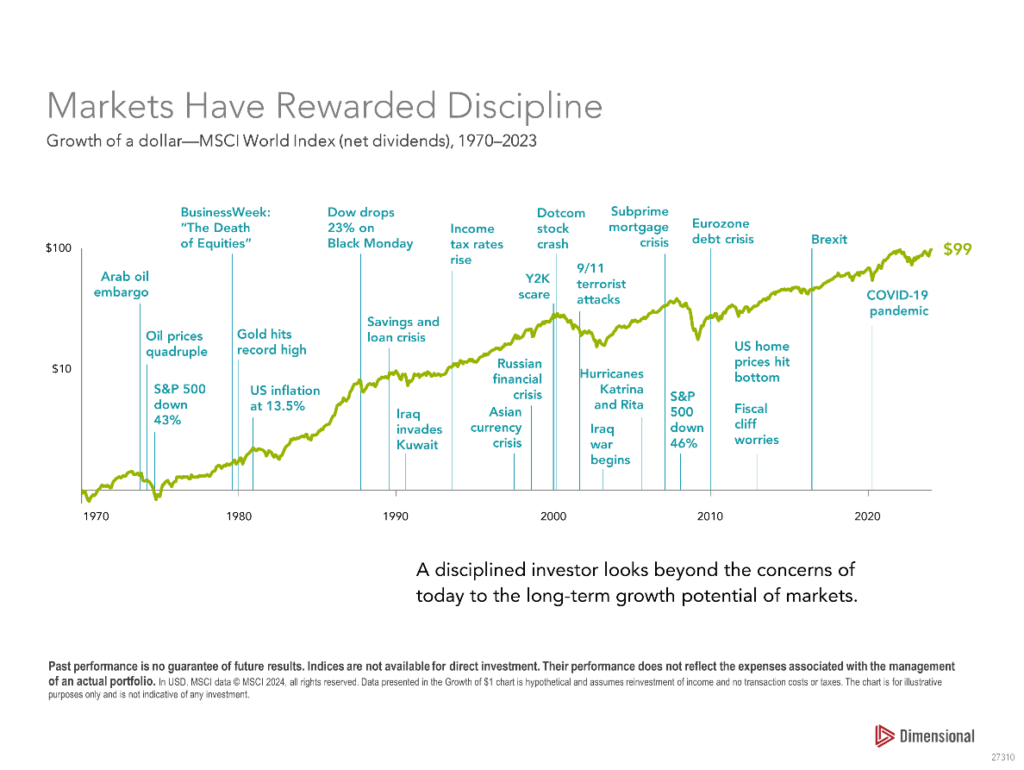

History has shown that staying the course — remaining invested despite short-term fluctuations — has been a winning strategy for long-term investors. Let’s take a closer look at why it makes sense to avoid emotional reactions.

Short-term market volatility refers to temporary price fluctuations caused by factors like economic reports, geopolitical events, interest rate changes, or investor sentiment. These swings can be dramatic, but they do not necessarily indicate a long-term market decline.

Markets have always experienced periods of volatility, but they have also historically rebounded and grown over time. Consider past market corrections — despite downturns, long-term investors who stayed the course have seen positive returns as markets recovered.

Behavioral finance is the study of how psychological influences affect financial decisions, and it aims to explain why those emotional reactions can often lead to poor investment choices.

Researchers in behavioral finance often study behavioral biases, or systematic errors in thinking and decision-making, that can affect an investor’s ability to make rational financial choices. When it comes to market volatility, some of the most common behavioral biases we might observe include:

These psychological tendencies can push investors to make rash decisions that undermine their long-term financial goals.

A real-world example illustrates just how costly emotional investing can be. Studies have shown that investors who panic and sell during a downturn often miss the market’s best recovery days.

For example, according to research by J.P. Morgan, missing just the 10 best market days over a 20-year period can significantly reduce overall returns. Markets often experience their best days shortly after the worst ones — meaning that those who exit during downturns are more likely to lock in losses and miss out on the eventual rebound.

Simply put, mistimed exits can erode long-term portfolio growth, making it harder to achieve financial goals.

History has shown that markets have always bounced back from downturns, rewarding long-term investors for their patience. But staying invested is about more than just market growth. It also allows compounding to work in your favor, helping your money grow over time. Additionally, by continuing to invest during market dips — a strategy known as dollar-cost averaging — you can buy at lower prices, possibly reducing your overall cost per share and helping to position yourself for greater long-term gains.

Short-term market volatility is a natural part of investing, but it does not determine long-term success. Instead of reacting to daily fluctuations, focus on your long-term financial goals, stay diversified, and trust in a disciplined investment strategy.

If you have concerns about your portfolio, please reach out to your advisor. Together, we can ensure your investments align with your long-term objectives and financial well-being.